Cloud adoption has transformed the way organisations build, scale and deliver digital services. With platforms like Microsoft Azure offering unprecedented flexibility and speed, it’s no surprise that businesses are shifting more of their infrastructure to the cloud. But with this agility comes a new challenge: managing cloud costs that can fluctuate wildly and grow unexpectedly.

Enter FinOps: a modern approach to cloud financial management that helps organisations gain visibility, control and accountability over their cloud spend. It encourages collaboration between finance, engineering and operations teams.

In this blog, we explore everything you need to know about FinOps, and how it can fuel efficiency in the cloud era.

What is FinOps?

FinOps, short for Financial Operations, is a cloud financial management discipline that enables organisations to get maximum business value from their cloud investments. It’s a collaborative operating model that brings together finance, engineering and business teams to make smarter, data-driven decisions about cloud usage.

At its core, FinOps is about transparency, accountability and agility.

In traditional IT environments, financial control was centralised, with long procurement cycles and predictable costs. But in the cloud, where resources are provisioned on-demand and billed by usage, that model no longer works. FinOps shifts the mindset from centralised budgeting to shared responsibility, where teams are empowered to understand and manage the financial impact of their technical decisions.

This shift is crucial. Engineers should build with cost efficiency in mind. Finance teams are enablers of innovation, rather than gatekeepers. And business leaders gain real-time visibility into cloud spend, allowing them to align investment with strategic priorities.

So, by adopting FinOps practices, organisations can move faster, spend smarter and stay in control – without compromising on innovation.

Why FinOps matters more than ever

As cloud adoption accelerates, organisations are discovering that managing cloud spend is far more complex than traditional IT budgeting. It’s a double-edged sword: while it enables rapid innovation, it also introduces new challenges that FinOps is uniquely positioned to solve. These include:

1. Unpredictable cloud bills

Cloud services are billed based on consumption, which means costs can vary month to month depending on usage patterns. Without proper controls, it’s easy for teams to overprovision resources, leave unused services running or scale inefficiently. This unpredictability makes it difficult for finance teams to forecast spend or allocate budgets accurately.

FinOps tackles this by introducing real-time cost monitoring and forecasting tools, enabling teams to spot anomalies early and adjust usage before costs escalate.

2. Lack of visibility across teams

In many organisations, cloud usage is decentralised. Multiple teams deploy resources independently, often without a shared view of the financial impact. This siloed approach leads to fragmented reporting, duplicated services and missed opportunities for optimisation.

FinOps solves this by creating a unified view of cloud spend across departments, using tagging, dashboards and shared KPIs to ensure everyone understands where money is going and why.

3. Delayed decision-making

Traditional financial reporting cycles are too slow for the pace of cloud operations. By the time a cost issue is identified in a monthly report, the damage is already done. Engineering teams need timely data to make informed decisions about scaling, architecture and resource allocation.

FinOps enables real-time decision-making by embedding cost data into engineering workflows, allowing teams to act quickly and responsibly.

4. Misalignment between finance and engineering

Finance teams often focus on cost control, while engineering teams prioritise performance and uptime. Without a shared language or common goals, these priorities can clash, leading to friction and inefficiencies.

FinOps bridges this gap by fostering collaboration and shared accountability. Engineers gain awareness of cost implications, and finance teams better understand the technical context behind spend.

5. Difficulty in optimising cloud spend

Tools like Azure offer a wide range of pricing models, discounts and optimisation tools – but navigating them requires technical and financial expertise. Many organisations miss out on savings due to lack of awareness or capacity to act.

FinOps helps teams identify and implement cost-saving opportunities, such as reserved instances, rightsizing and automated scaling. This turns cloud cost management into a continuous improvement process.

FinOps principles and lifecycle

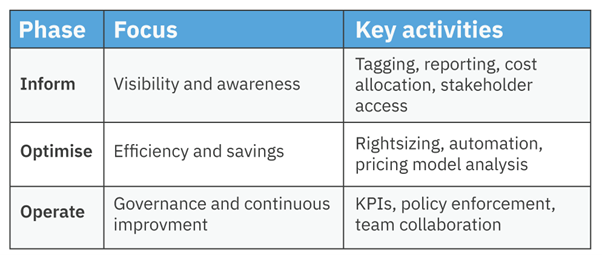

FinOps is a continuous, iterative process that helps organisations align cloud spending with business value. The FinOps lifecycle is typically broken down into three key phases: Inform, Optimise and Operate. Each phase builds on the last, creating a framework for ongoing financial accountability and efficiency in the cloud.

Let’s delve into the phases.

1. Inform: Creating visibility into cloud spend

This phase focuses on establishing clear, real-time visibility into cloud usage and costs. It involves:

- Implementing tagging and cost allocation strategies

- Building dashboards and reports for stakeholders

- Ensuring teams understand their cloud spend and its business impact

The goal is to empower teams with the data they need to make informed decisions and foster transparency across departments.

2. Optimise: Identifying and acting on cost-saving opportunities

Once visibility is in place, organisations can begin to identify inefficiencies and areas for improvement. This includes:

- Rightsizing resources (e.g. scaling down overprovisioned VMs)

- Leveraging Azure Reserved Instances and Savings Plans

- Automating shutdowns of unused environments

- Reviewing architectural choices for cost-effectiveness

Optimisation is a continuous effort to refine cloud usage and reduce waste.

3. Operate: Embedding FinOps into daily workflows

The final phase is about operationalising FinOps practices so they become part of the organisation’s culture. This involves:

- Setting KPIs and governance policies

- Creating feedback loops between finance and engineering

- Integrating cost awareness into CI/CD pipelines and sprint planning

- Conducting regular reviews and cost audits

By embedding FinOps into day-to-day operations, organisations ensure that financial accountability is sustained over time.

FinOps in the Azure ecosystem

Microsoft Azure offers powerful capabilities for building and scaling cloud infrastructure, but its flexibility can also introduce complexity when it comes to cost management. FinOps helps organisations navigate this.

While Azure provides the tools, FinOps provides the framework and culture to use them effectively. It ensures:

- Cost data is accessible and actionable across teams

- Recommendations from tools like Advisor are followed through

- Governance policies are enforced consistently

- Financial accountability is embedded into engineering workflows

FinOps turns Azure’s technical capabilities into strategic business value, helping organisations innovate confidently while staying in control of their cloud spend.

Azure tools that support FinOps

- Azure Cost Management + Billing: Provides dashboards, budgets and alerts to monitor and forecast spend. It integrates with Microsoft 365 and Power BI for deeper analysis.

- Azure Advisor: Offers personalised recommendations to improve performance, security and cost-efficiency, such as identifying idle resources or suggesting reserved instances.

- Azure Reservations and Savings Plans: Allow organisations to commit to usage over time in exchange for significant discounts, ideal for predictable workloads.

- Management Groups and Resource Tags: Help organise resources hierarchically and apply governance policies for better cost tracking and accountability.

Common FinOps use cases

FinOps can be applied across a wide range of cloud operations. Below are some of the most common and impactful use cases:

1. Budgeting and forecasting cloud spend

Cloud costs can fluctuate based on usage, making traditional budgeting methods less effective. FinOps introduces real-time cost tracking and predictive analytics to help teams:

- Set accurate budgets based on historical and projected usage

- Monitor spend against targets throughout the month

- Adjust forecasts dynamically as workloads scale

This enables finance and engineering teams to plan with confidence and avoid end-of-month surprises.

2. Rightsizing virtual machines and services

Overprovisioned resources are one of the biggest drivers of unnecessary cloud spend. FinOps encourages continuous evaluation of resource utilisation to:

- Identify underused VMs, databases, and storage

- Scale services to match actual demand

- Decommission unused or duplicate resources

In Azure, tools like Advisor and Monitor can support this process with actionable insights.

3. Implementing chargeback and showback models

To foster accountability, many organisations use chargeback (billing teams for their usage) or showback (reporting usage without billing). FinOps helps:

- Allocate costs accurately using tagging and resource groups

- Create transparent reports for stakeholders

- Encourage responsible usage by showing the financial impact of decisions

This is especially useful in multi-team or multi-project environments where shared cloud infrastructure is common.

4. Governance through tagging and policy enforcement

Effective tagging is foundational to FinOps. Without it, tracking spend by team, project or environment becomes nearly impossible. FinOps supports:

- Defining and enforcing consistent tagging policies

- Using Azure Policy to automate compliance

- Auditing resource configurations to ensure governance

This ensures that cost data is meaningful and actionable across the organisation.

Building a FinOps culture

For FinOps to work, organisations need to embed financial accountability into their cloud operations, ensuring that cost-awareness becomes part of everyday decision-making. Here’s how:

1. Drive cross-functional collaboration

FinOps thrives on collaboration between finance, engineering and business teams. To build this culture:

- Schedule regular cross-team reviews of cloud usage and spend

- Use shared dashboards to surface cost data in a way that’s meaningful to all stakeholders

- Encourage open conversations about trade-offs between performance, cost and delivery speed

2. Empowering engineers with cost data

Engineers make daily decisions that impact cloud spend, yet they’re often disconnected from the financial implications. FinOps encourages:

- Giving engineers access to real-time cost data through Azure dashboards

- Embedding cost metrics into DevOps workflows and CI/CD pipelines

- Providing training on Azure pricing models and optimisation strategies

Tools such as Azure Advisor and Monitor help engineers make informed choices without slowing down innovation.

3. Creating KPIs and accountability frameworks

To sustain FinOps practices, organisations need clear metrics and ownership. This includes:

- Defining KPIs like cost per workload, budget adherence and optimisation rate

- Assigning budget responsibility to product owners or team leads

- Reviewing performance regularly to identify areas for improvement

Tagging and resource group features support granular tracking, making it easier to tie spend to specific teams or projects.

4. Outsourcing FinOps expertise

For organisations new to FinOps or lacking internal capacity, outsourcing can accelerate adoption. External consultants can:

- Audit current cloud usage and identify inefficiencies

- Design governance frameworks tailored to Azure environments

- Provide ongoing support and training to internal teams

Outsourcing doesn’t replace internal ownership; it complements it by bringing in specialised knowledge and helping teams build confidence in their FinOps journey.

Start with FinOps

FinOps isn’t just about cutting costs (though that’s welcome in the current climate). It’s about making smarter, more informed decisions that align cloud investments with business outcomes.

In a world where agility and scalability are essential, FinOps provides the structure needed to stay financially disciplined without slowing down innovation.

Whether you’re managing a multi-team Azure environment or scaling digital services across departments, FinOps helps bring clarity, control and collaboration to your cloud strategy. It empowers teams to take ownership of their usage, understand the financial impact of their choices, and continuously improve how resources are consumed.

If you’re exploring how FinOps could fit into your Azure ecosystem, our team can help assess your readiness, identify opportunities and guide your journey toward a more cost-aware, agile cloud culture.

Find out how we can make more of your cloud investments.