Almost every aspect of business has become heavily digitalised in recent years. However, there are a few processes that seem stuck in the past – and this often includes financial operations.

Finance teams are the backbone of an organisation. So it’s crucial they’re efficient and equipped to deal with modern challenges. This means welcoming and investing in future-proofed processes.

Traditional processes like spreadsheets and legacy accounting systems no longer cut it. Newer solutions are needed to drive productivity and share vital data.

In this blog, we explore the most significant challenges facing financial operations in 2024 – and how to adapt to modern your processes before they start underperforming.

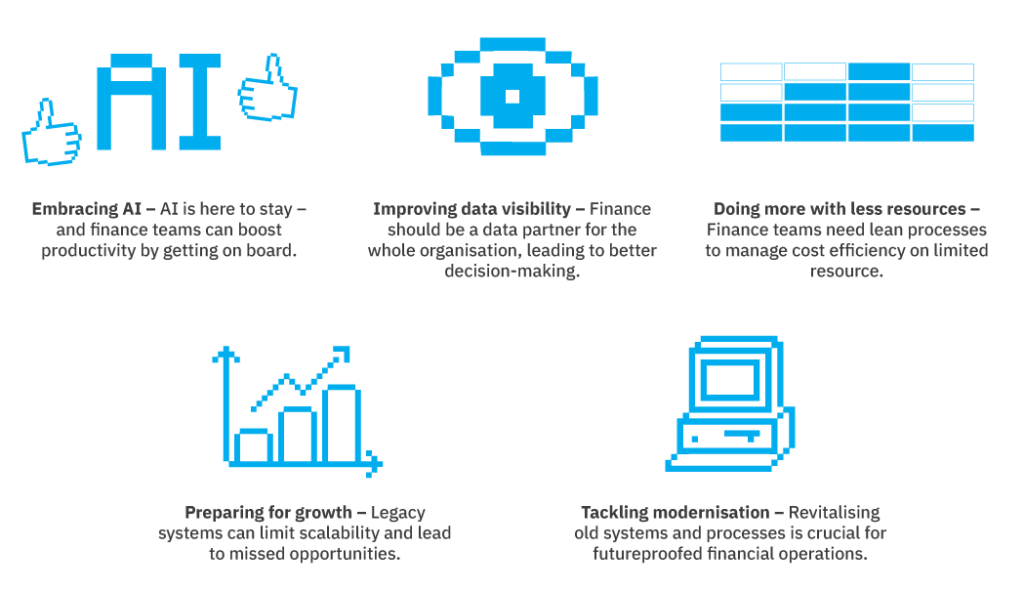

Challenge #1: Catching the AI and Microsoft Copilot wave_

2023 was the year of AI, with the likes of Copilot, Bard and ChatGPT entering everyone’s vocabulary. The AI revolution shows no signs of slowing, with 64% of CFOs are investing in new technologies like AI.

Those who don’t embrace AI run the risk of being left behind. While many people fear AI will make humans redundant, it can in fact augment the skills of your staff and make their jobs easier. It automates administrative tasks associated with finance, freeing staff to focus on high-value work.

Generative AI in particular promises huge benefits. By learning from you over time, it helps finance teams predict cash flow accurately and gain better insight.

But embracing AI means substantial change for any organisation. There’s still a lot of uncertainty and anxiety around AI.

However, the answer is finding the right tools. Many leading technology companies are leveraging AI to deliver powerful and secure solutions. Understanding the benefits of these will help you to overcome any concerns and better understand the benefits.

Challenge #2: Improving data visibility across financial operations_

Technological advancements, like AI, give you more access to data than ever before. In today’s age of customised experience and insight, people also need real-time data that allows them to act quickly and make smarter decisions.

Finance teams is particularly hold a large volume of data, including budgets, balance sheets and financial forecasts.

But the need for data is company-wide. While the vast amount of it may sit in the finance team, everyone needs sight.

You need to offer total visibility to those who need it, when they need it, rather than relying on end-of-month reports. This is something many legacy systems are not capable of, resulting in manual and time-consuming processes to share and collaborate on data.

The hybrid nature of many organisations and visibility makes data sharing even more crucial and complicated.

By investing in cloud-based solutions, like Business Central, it becomes much easier to share data with those who need it. This allows finance to become a data partner and empower smarter company-wide decisions.

Challenge #3: Doing more with less_

We’ll state obvious: times are tough. With many companies cutting budgets in the face of economic uncertainty, teams must do more with less. For finance teams, that means finding ways to cut costs and maximise profit on limited resources.

In 2024, AI and technology can help to bridge the resource gap. But it’s crucial to find the right solutions. 88% of CFOs and other business executives say they struggle to capture value from their technology investments. Choosing the wrong tools can drain resources further.

With the right solutions, you’ll be able to build optimised processes that boost productivity. So, you can do more without having to worry about additional labour costs.

You’ll also maintain lean costs that benefit the business during economic uncertainty. It will also prevent cost increases being passed onto customers, allowing you to remain competitive.

Challenge #4: Welcoming growth_

Although many companies are currently focusing on lean practices, that doesn’t mean you shouldn’t also be planning towards growth.

Growth often starts with financial operations. But if the finance teams’ processes are outdated – like working from spreadsheets or legacy systems – it isn’t scalable. You’ll find yourself limited, leading to inefficiencies, frustration and ineffectiveness.

Plus, these systems often don’t provide the data visibility to empower the intelligent decisions that lead to growth.

In the event of mergers, acquisitions or organic growth, you need systems and processes that can evolve with you.

Challenge #5: Moving towards the future_

In an increasingly modern world of data and tech, many businesses risk becoming obsolete if they refuse to stay up to date.

The challenges we’ve mentioned already are crucial in futureproofing your financial operations. but modernisation is a challenge in itself. It requires careful change management, updated infrastructure, up-skilled staff and the right tools.

To do it efficiently, you need to bring your team and entire organisation on board, invest in the right technology and commit to the evolution. Every finance team is different, so you will need to find an approach that works for yours.

Getting support from the right partners is going to be crucial in making sure the change succeeds.

Improving your financial operations in 2024

It’s more crucial than ever to embrace the future. The new world of digital is coming fast. And by embracing AI, improving processes and optimising for growth, you will be prepared.

By modernising, there are many benefits to gain: increased productivity, accuracy and cost-effectiveness. This will give your finance team more capacity, job satisfaction and better performance. But most importantly, you will allow your financial operations to operate as it should: as the data core of the business. It will provide insight that encourages other teams to work better and contribute to overall success.

Are you ready to bring your financial operations into the new age? Microsoft Business Central can replace your legacy software with a leading cloud-based accounting system. It is entirely customised to your needs, meaning you’ll have everything your team needs to thrive.

Plus, with support from Microsoft Copilot, you’ll be able to automate those common tasks without compromising your finance data.