In response to the explosion of AI, Microsoft are embedding Copilot into all their apps. This includes Dynamics 365 Business Central – Microsoft’s flagship finance and ERP platform for small, medium and lower enterprise organisations.

Microsoft have provided an overview of this capability on their blog.

However, we want to explore the practical implications of these innovations, based on our experience deploying Business Central into many industries and from immediate feedback during our demonstrations.

Reclaim time with conversational chat_

One key feature within Copilot is conversational chat. At the time of writing, this is only available within the US environment of Business Central (BC). However, it will soon appear within the UK (and other English speaking) environments. In my opinion, this will likely have the most transformational impact of copilot on day-to-day use.

One key driver for implementing D365 BC is the need for reporting. Long have we demonstrated the ability to use natural language to interrogate Power BI but this still requires data to be extracted, transformed and loaded (ETL) into the platform. Now, users can ask natural questions of their data – in real time – within the BC App.

One of the wonderful features of Copilot is to ask further questions of the data returned – effectively drilling down into the results. It gives answers to the user’s question and links to prove it.

The other aspect of Chat with Copilot is training. Users can now ask how to complete a task. While Microsoft offer detailed information across the Microsoft Learn Platform, users still need to search.

Copilot allows users, without leaving their app, to ask questions such as “how do I close year end”. Immediate advice is provided, plus a link to the specific Microsoft Learn page. This gives the immediacy users require.

Stop writer’s block with text suggestions_

Across all apps, one of the ideal use cases of Copilot is writing narrative text. Whilst this isn’t always perfect, it is far easier to edit than create text.

Often, users wish to write a suitable ‘blurb’ – a marketing description of a product. This can be challenging for the non-marketers around. Copilot will generate a block of text suitable for marketing. Users can choose the tone of voice – from formal to creative (along with other parameters):

Copilot uses the Item Attributes (a relatively under-used feature in BC) to generate the text. The results are often very cheesy (dependent on the input). Invariably, marketing executives will write better copy – they will also consider their target audience, localisation, and brand message. But as noted above, it’s a great starting point.

BC integrates natively with Shopify – and as a retailer, this provides tangible benefit. As a ’showcase’ feature, it looks great in a demo – but as ChatGPT and Copilot become more pervasive, we will only show this were it has clear benefit to the client.

Streamline the sales order process_

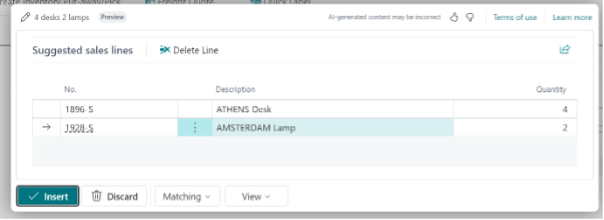

This is a very new feature: the ability to write natural text such as ‘4 desks, 2 lamps’ and receive suggested sales lines:

This works well – to a point. Outlook integration demonstrations allow us to show clients how an email asking for ‘4 desks, 2 lamps’ in the body of the text can be converted to a sales quote – it’s the same idea.

The principle and technology is fantastic – but in reality, users will be more structured. A client’s PO will have codes; even an email will have a small table. Copilot will help translate customer item numbers, but the ability to “edit in excel” and upload lines is still more effective.

Unless we see a change in customer behaviour, like the Outlook demo, this is better as a demo in principle rather than a feature we see being used regularly by BC users.

Leverage automation_

First of all, this will be available for preview in the US environment in July – so we can’t yet demonstrate or test this. However, there are still a couple of points worth making.

Users of Copilot already have the ability to create a Power Automate flow using natural language. ‘Describe it to design it’ is one of the options when creating a new flow.

As with all the Copilot aspects, it’s not what you say, but how you say it. Using the most appropriate language will provide most beneift in generating an outline flow. Users still need to review these and update parameters to make the flow work as desired. Copilot gives the user a great starter for 10, but it will still need review and refinement before being production ready.

More importantly, this draws the attention of Business Central users to the concept of workflow. Business Central and its forerunner Dynamics NAV are customisable. In many cases, the changes specific for a client actually relate to a workflow. Examples include ‘When X happens I need to know’ or ‘when Y happens – update the order’.

Power Automate is now embedded in every screen. Yes, there are some complexities around specific tables, triggers etc. Yes, the user needs to be able to cope with other connectors (e.g. Outlook, Teams etc). But given there are over 300 connectors covering all types of apps, platforms and software, Power Automate is a powerful integration tool as well as a workflow.

Users of Business Central should consider which workflows will drive the best business benefit to them, and work (either internally or with their partner) to leverage Power Automate as part of their subscription.

Automated bank reconciliation_

Typically, in finance teams, there are two thoughts for users. Either bank reconciliation is a triviality – a month-end chore which is done with little fuss or bother. Or it’s one of the most complex and mind-numbing tasks a finance user has to deal with. Those industries which have high volume, small value transactions will have dedicated resources reconciling bank entries on a daily basis.

For some time, Business Central has had the ability to import a bank statement and match automatically. The system allows users to enter a date range but often the system would miss many obvious matches. In particular, if multiple bank ledger entries correspond to a single bank entry, this would be missed.

But no more. Copilot will now try and match many more transactions. Any additional help will be welcome by those finance users described above who find reconciliation a challenge and a chore. It remains to be seen how effective this is, and how finance enter those bank ledger entries will determine how well Copilot operates. Either way, this is a clear benefit.

From a demonstration point of view, it is hard to show effectively – but there are great videos from Microsoft: https://youtu.be/jhfwx1K0I7Y

E-invoice matching_

In Europe, e-invoicing is mandatory. Whilst this hasn’t yet been imposed in the UK, there is clear government guidance and companies should expect this to be required in the future.

As an evergreen SaaS platform, built for worldwide requirements, companies using Business Central do not need to worry.

Whilst this isn’t the same as OCR (such as Continia’s Document Capture) which transforms PDF or scanned documents into an electronic format, Business Central will assist with matching vendor e-invoices to purchase orders. We know that invoices can often differ (price and quantity) from the original order – and Copilot is there to assist when this happens.

Ultimately, the proof will be in the adoption (mandatory or otherwise) of e-invoicing. Hopefully, unlike the SEPA Standard for banks in Europe which has largely been ignored by UK banks, e-invoicing will introduce standards to make the purchase invoicing process much more efficient.

Improve analysis_

Microsoft introduced an ‘analysis tab’ function recently as part of its bi-annual Wave updates. This was transformative, allowing users to create pivot table-style analysis views on any list of data.

However, users still needed to understand the fields, and how they could create a table based on the questions they needed answering.

Copilot addresses this, by allowing users to ask natural language questions of the data. It will then generate tables automatically for them.

This has also been added to all lists of data across the solution – not just within the general ledger.

One of the features that has always been available is the ability to interrogate data live in the system. Where other systems require a report to be run to calculate balances, Business Central shows that balance on the screen and allows users to drill down to interrogate it. Now, users can drill down and then summarise using Copilot and analysis tabs.

Drive inventory forecasting_

This isn’t a direct Copilot feature, but does use Azure AI. Managing inventory levels and purchasing is clearly a complex, fast-changing task. Many clients rely on experience and intuition along with some basic parameters (e.g. re-order level). Forecasting using AI brings science and data to assist this process, to improve the accuracy and thereby help clients manage their working capital better.

There are two factors to consider in relation to this feature. First, the client needs to have items, so it’s most useful for the likes of manufacturing and distribution.

Secondly, the Azure AI engine needs lots of data. This is a feature which will come into its own after go-live and after data has been built up. Of course, historic data can be added to the model but this requires amending the model in Azure Machine Learning Studio – not necessarily something the average user will do.

Predict late payments_

All companies potentially can suffer from credit control issues, and need to manage cash receipts carefully. Often, credit controllers will know the clients which may delay payments to manage their own cash flow, or those clients who often find reasons to not authorise invoices received.

Credit controllers can manage this, and there are some excellent extensions from Microsoft AppSource which add additional functionality around collections. This feature, again using Azure AI rather than Copilot, will help users identify trends that they may not be aware of.

But, as with inventory forecasting, this will only work with a great deal of data. The model will need to be trained and then will improve over time.

Improve cash flow analysis_

The third and final feature (for now!), using Azure AI, is the ability to predict cash flow.

When generating a cashflow report, the user has an option to enable Azure AI which will help refine the calculation. But once again, this will require a great deal of data before delivering a relevant prediction.

Our summary_

Copilot, Microsoft’s tool for the future is here – and it’s in Business Central. Coupled with Azure AI, these AI solutions are transforming the finance and ERP user experience.

Different users will benefit from the different options – but the two which are most likely to be used most frequently are conversational chat and analysis tabs.

The other thing to note is this is only the first Wave to release Copilot – Microsoft are just starting! We’re extremely excited to see what they will do in the future.